BASEL, Switzerland (AN) — The global financial institution that supports central banks has a new blueprint for the world's future monetary system, and it's not based on crypto.

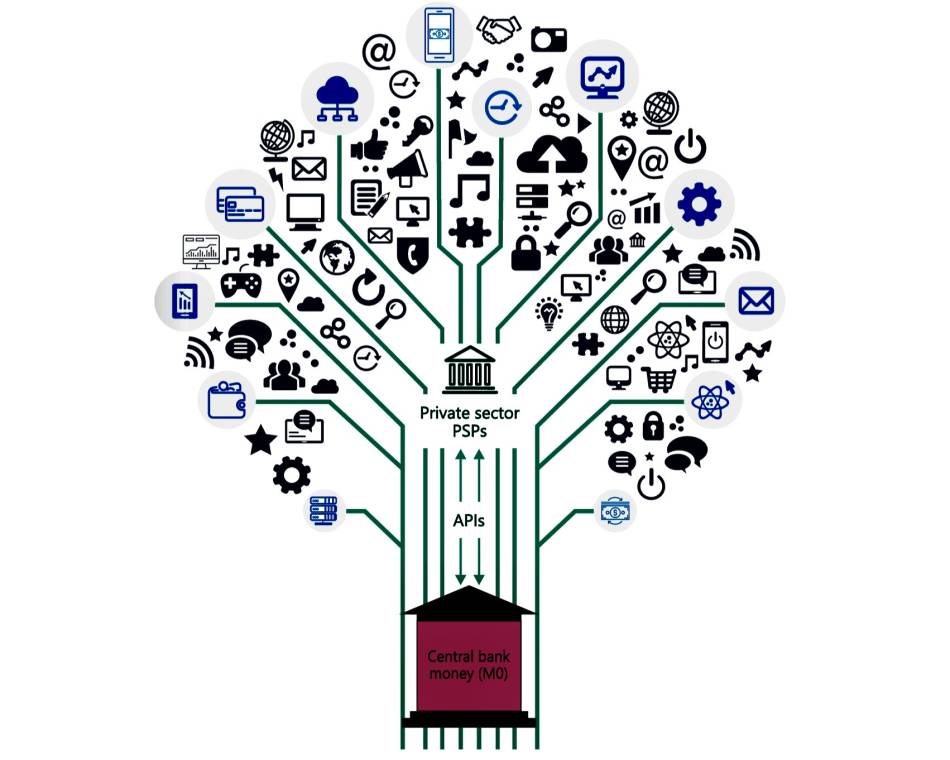

The future, says the Swiss-based Bank for International Settlements, will be built around central bank digital currencies, or CBDCs, which are digital representations of central bank-issued money.