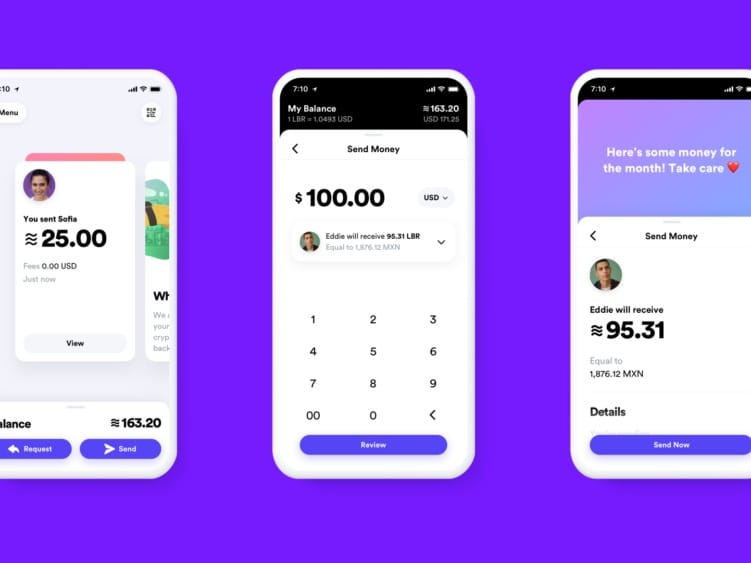

GENEVA (AN) — Facebook announced plans to launch a new digital currency and international organization to oversee it based in Switzerland's hub of multilateralism and Bitcoin-like cryptocurrencies.

The social network's new Libra cryptocurrency is to be managed by the new Libra Association, headquartered in Geneva, home to the United Nations' European headquarters and hundreds of other international organizations, treaty secretariats and nations' diplomatic missions.